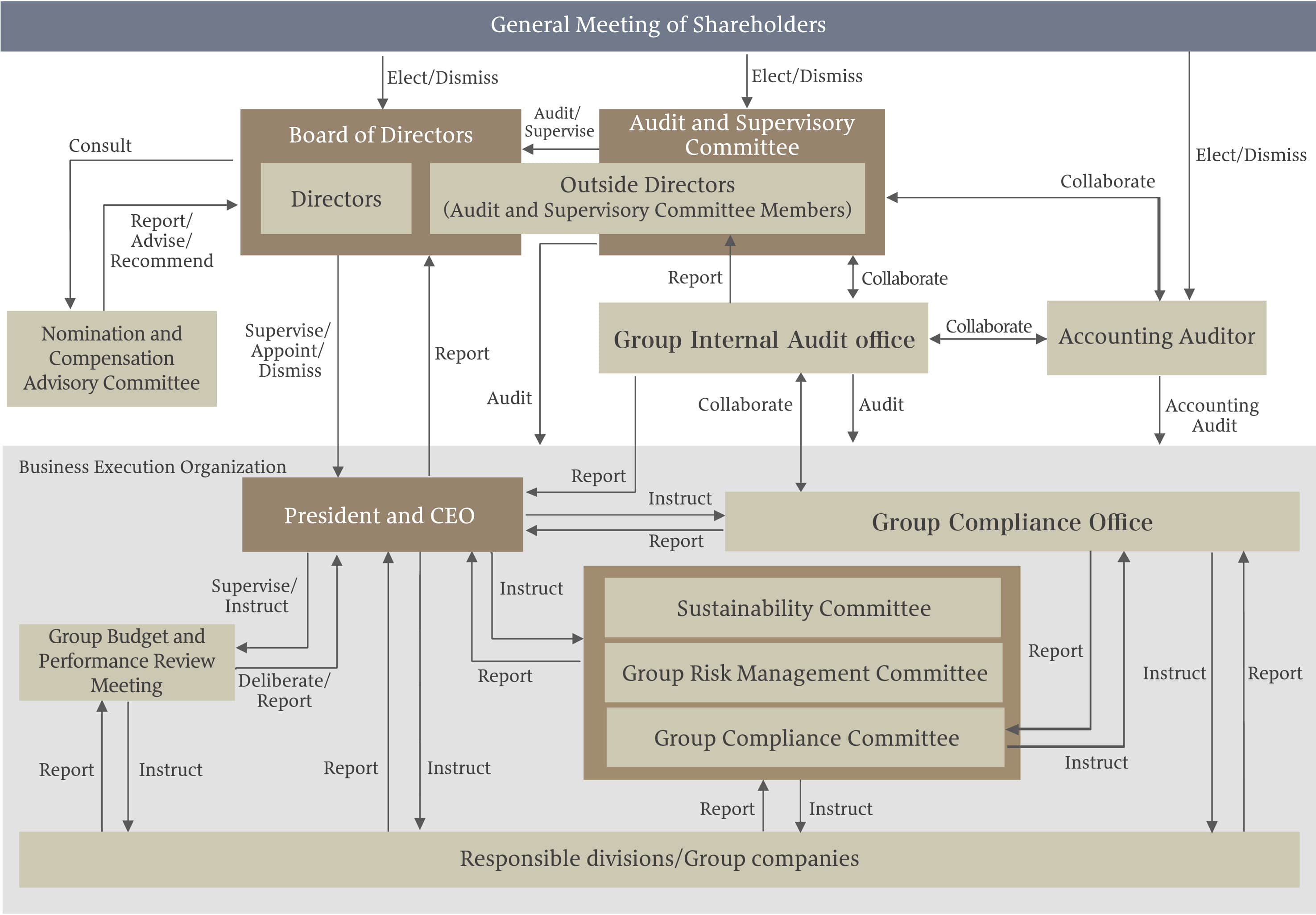

The Company has established the Group Internal Audit Office. The Group internal audits are conducted by two Group internal auditors who are dedicated to auditing work.

As a general rule, the Group Internal Audit Office conducts audits of the Company and Group companies once every year with a view toward improving business efficiency, complying with regulations, the growing importance of compliance and a shared supervisory function based on the authorization of duties.

Audit results are promptly reported to the Representative Director, President and Chief Executive Officer, while the results and issues for improvement are referred to the Company and Group companies. To increase audit effectiveness, projected plans for remedial actions on those issues must be submitted to the Representative Director, President and Chief Executive Officer, who is responsible for audits.

In addition, the Group Internal Audit Office reports directly to the Representative Director as well as to the outside directors who are audit and supervisory committee members, on the audit results and projected plans for remedial actions on issues for improvement. This strengthens its monitoring function toward management while ensuring the effectiveness of internal audits.

Corporate Governance Report

Corporate Governance Report