The Group conducted a scenario analysis based on the TCFD recommendations to estimate the risks of, opportunities for and financial impact on its own business activities.

Climate change risks and opportunities

Climate change risks and opportunities in the 2-dgree and 4-degree scenarios are identified in the table below.

|

Type |

Item |

Impact on

business |

Impact on business and finance |

Impact

period |

| 2℃ or lower |

4℃ |

| Transition risk |

Regulatory policies |

Introduction of carbon pricing (carbon tax, etc.) |

Introduction of a carbon tax will increase business costs |

→ |

→ |

Medium to long |

| Market |

Changes in market structure |

If many companies fail to transition in the long term, changes in corporate competitiveness and corporate value will impact the consulting business |

↑ |

↑ |

Short to medium |

| Transition to decarbonization |

SG&A costs will increase due to the use of renewable energy and carbon offsets |

→ |

→ |

Short to medium |

| Physical risk |

Chronic |

Changes in climate patterns (higher average temperature, etc.) |

Rising temperatures will disrupt our employees' work and increase our response costs |

→ |

↑ |

Medium to long |

| Acute |

Extreme weather conditions (intense heat, heavy rains, more frequent typhoons, rising sea levels) |

Natural disasters will harm social infrastructure and businesses, and cause economic activity to stagnate. The earnings of clients will deteriorate, affecting the consulting business |

→ |

↑ |

Medium to long |

| As global warming progresses, the frequency of outbreaks of heat stroke and pandemics of infectious diseases will increase. If employees become ill, our business continuity will be affected |

→ |

↑ |

Medium to long |

|

Item |

Impact on

business |

Impact on business and finance |

Impact

period |

| 2℃ or lower |

4℃ |

| Opportunities |

Market changes |

Consulting needs will increase as the transition to achieve Japan's nationally determined contributions accelerates and as the need to create strategies, capital policies, etc., for the transition to decarbonization increases |

↑↑ |

↑ |

Short to medium |

| Transition to decarbonization |

Business costs will decrease due to resource and energy conservation |

→ |

→ |

Short to medium |

| Changes in customer reputation |

As ESG information disclosures were requested or required, and awareness of sustainability increases, the need for related consulting services will increase |

↑↑ |

↑ |

Short to long |

| Changes in investor reputation |

In response to customers' transition to decarbonization, consulting needs to attract ESG investment and support needs for environment-related shareholder proposals will increase |

↑↑ |

↑ |

Short to medium |

If natural disasters intensify and abnormal weather leads to economic stagnation, an impact on our consulting business will be realized. Meanwhile, consulting needs for institutional shareholder relations, voting rights, and M&A support are expected to increase, in association with the transition to a decarbonized society and adaptation to climate change.

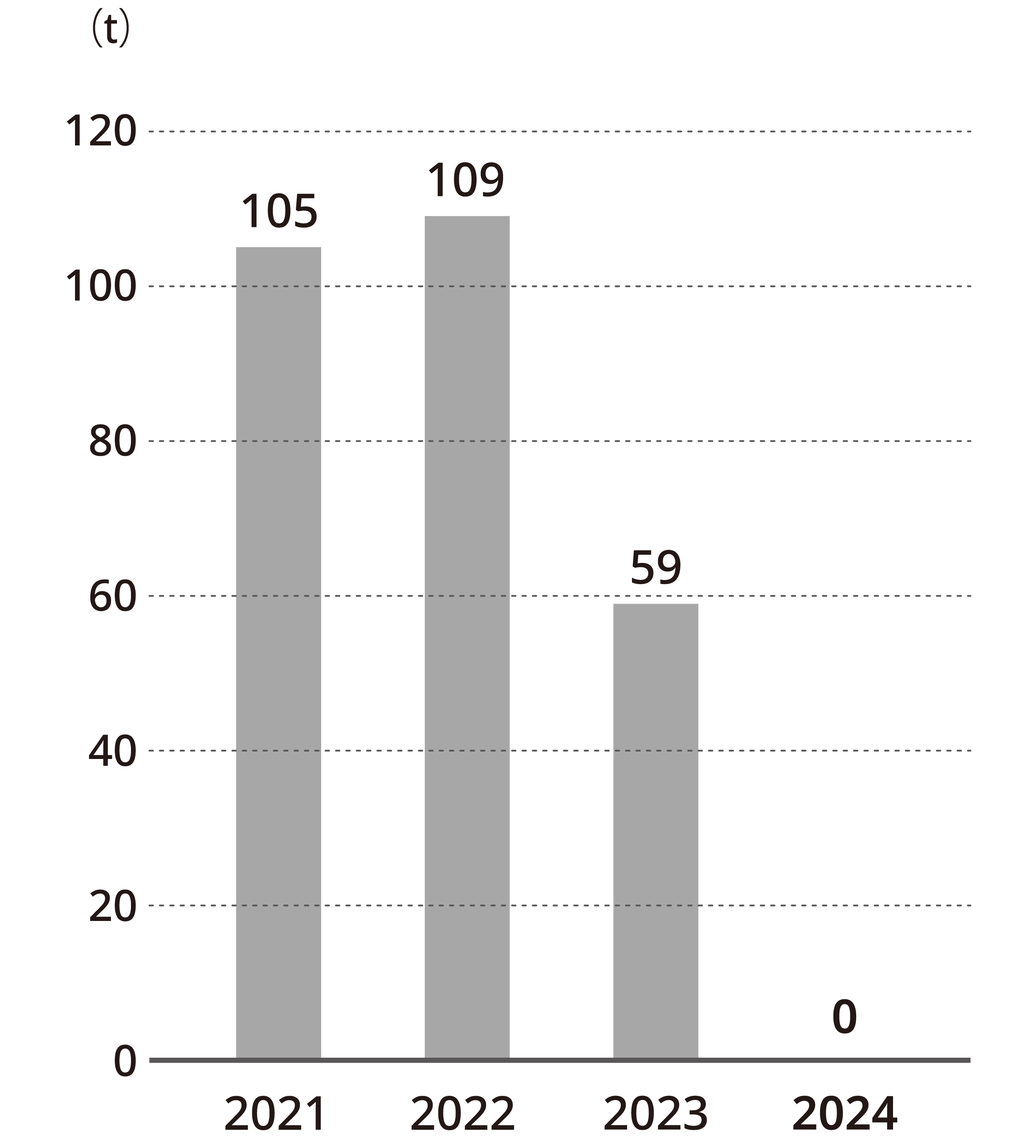

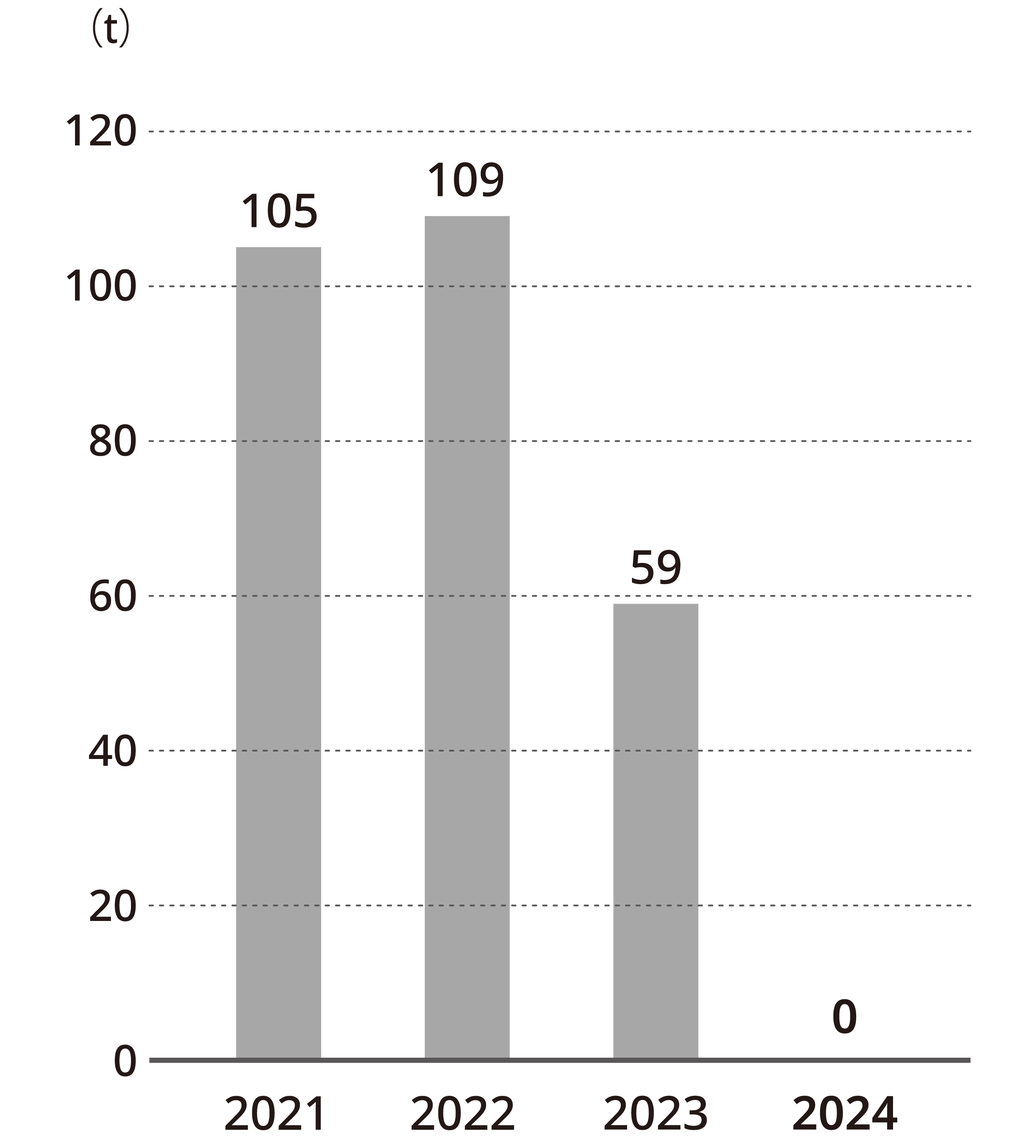

Greenhouse gas (GHG) emissions

As the Company has zero Scope 1 emissions (direct emissions from operations), we calculated our Scope 2 emissions (indirect emissions from electricity consumption). During the fiscal year ended March 31, 2024, we completed the switch to electricity derived from renewable energy for 100% of the electricity used in our business activities. As a result, we have achieved net zero for Scope 1 and Scope 2 emissions and maintained that status in the fiscal year ended March 31, 2025.

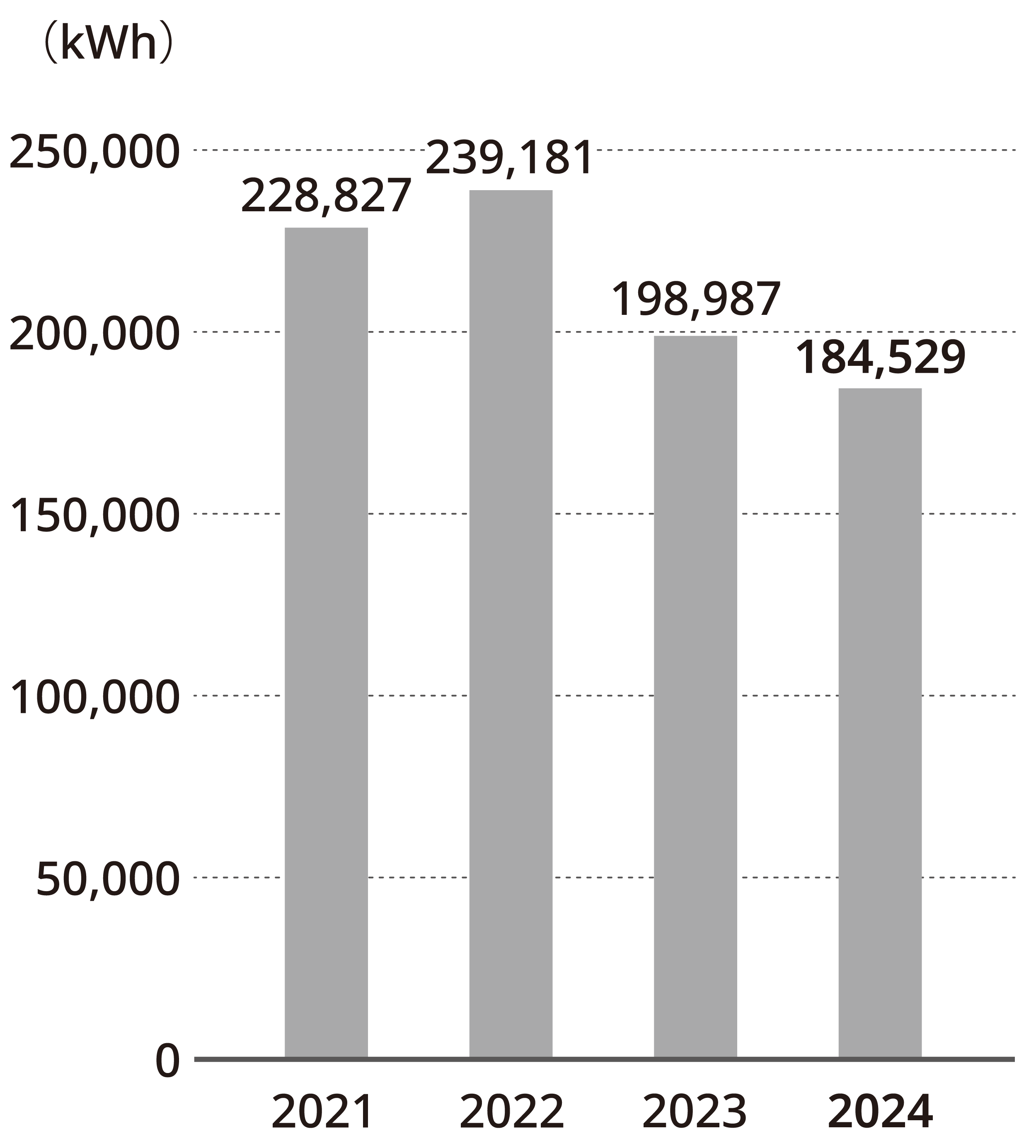

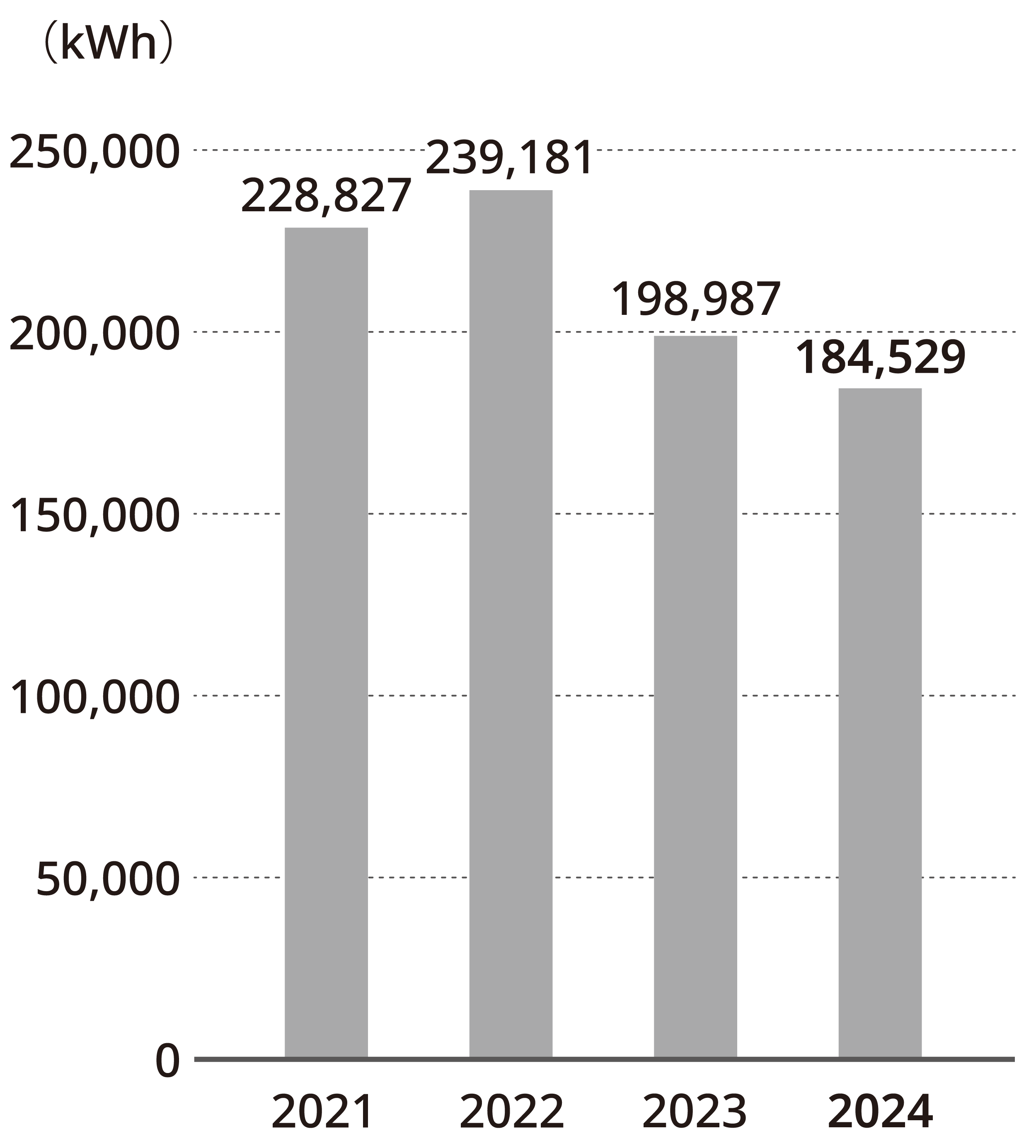

Energy consumption

GHG emissions

Financial impact

One financial impact of climate change risk that can be assumed is the introduction of carbon pricing (carbon tax, etc.). Accordingly, we estimated the carbon cost in 2030 and 2050 for the 4-degree scenario and the 2-degree scenario with GHC emissions at their current levels. The International Energy Agency scenario, the International Renewable Energy Agency scenario and the current carbon price (emissions trading system, carbon tax and energy tax) were used in our calculations.

| Year |

2030 |

2050 |

| 4-degree scenario |

223 |

1,076 |

| 2-degree scenario |

453 |

1,803 |

Risk Management

In the Group, the head of each organization, including senior general managers and general managers, identifies operational risks on an organizational basis, analyzes and evaluates these risks, and reports them to the Sustainability Committee. If a risk that needs to be addressed is discovered, the Sustainability Committee oversees risk management and supports risk management by selecting a person responsible in each organization to address the identified risk and have him or her take necessary measures. In addition, in the event that the Sustainability Committee discovers a significant risk, it will promptly report it to the Board of Directors.

Climate change risk is also positioned as one of the most important risks for the entire Company. In response, the Sustainability Committee evaluates climate change risk and reports the details of its review and its response to the Board of Directors at least once a year.

Goals

The Company’s goal was to reduce GHG emissions (Scope 1 and 2) from electricity consumption to net zero by 2025. However, during the fiscal year ended March 31, 2024, we completed the switch to electricity derived from renewable energy for 100% of the electricity used in our business activities. As a result, we have achieved net zero for Scope 1 and Scope 2 emissions. The Group will continue to promote initiatives to reduce the environmental impact and pursue carbon neutrality to realize a decarbonized society.